Gelex: Set a revenue target of VND 36 trillion in 2022, grew by 26%, listed Gelex Infrastructure and invested in 1,900 hectares of new industrial park

On April 5, GELEX Group’s General Director Nguyen Van Tuan signed a report to the General Meeting of Shareholders on business results in 2021 and business plan in 2022.

Gelex’s AGM would be held virtually on Thursday, May 12, 2022. The closing date of the right to attend the general meeting of shareholders is March 31, 2022.

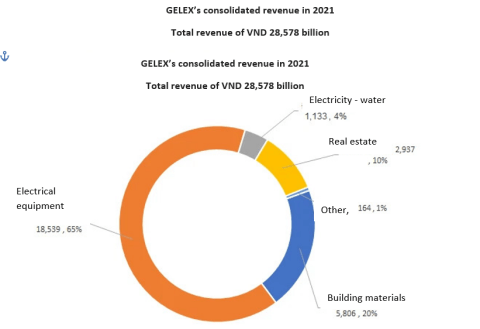

Specifically, thanked to the consolidation of Viglacera Corporation – JSC (Viglacera), in 2021, although the economy was heavily affected by Covid, GEX completed its business plan with consolidated net revenue of VND 28,578 billion, increased by 59.2% compared to 2020, consolidated profit before tax reached VND 2,057 billion, exceeding the plan by 60% and growing by nearly 72% compared to 2020.

Gelex restructured the group into two segments: Industrial production (Gelex Electrical Equipment JSC – Gelex Electric) and Infrastructure segment (Gelex Infrastructure JSC).

With the industrial production segment, Gelex Electric currently managed capital at its member units in two areas: electrical equipment industry and power generation.

The electrical equipment segment recorded a revenue of VND 18,539 billion, up by 15% compared to 2020. The profit margin of this segment decreased slightly compared to 2020 due to the increase in the price of raw materials, especially non-ferrous metals (copper, aluminum, etc.), the policy of lockdown, prolonged social distancing reducing market demand and increasing the cost of epidemic prevention and control.

The power generation segment recorded growth in both revenue and profit, contributing VND 608 billion in revenue, up by 67% compared to 2020.

In the segment of infrastructure, in the second quarter of 2021 Gelex dominated Viglacera Corporation, increasing the contribution of the infrastructure segment to the group’s overall business results.

Specifically, the sale and rental of real estate and industrial park infrastructure contributed VND 2,937 billion, and the construction materials segment contributed VND 5,806 billion to the Group’s consolidated net revenue.

Regarding the real estate, Gelex started and constructed according to the schedule of the project “Complex of hotels, commercial services and leasing offices” at 10 Tran Nguyen Han and 27-29 Ly Thai To, Hoan Kiem district, Hanoi.

In 2021, Viglacera Tien Son JSC (Subsidiary of VGC) bought Bach Ma factory, invested additionally for Viglacera Eurotile factory project (My Duc 2 factory)

The clean water segment contributed VND 525 billion to the group’s consolidated revenue, slightly down compared to 2020.

With the energy segment, in 2021 Gelex completed the investment in a cluster of 5 wind power projects in Huong Hoa district, Quang Tri province (total installed capacity 150mW) before October 31, 2021, eligible to enjoy electricity prices Government incentives

In 2022, the Group set the profit growth plan of 27%

In 2022, Gelex achieved the target of VND 36,000 billion in revenue and VND 2,618 billion in consolidated profit before tax, up 26% and 27.2% respectively compared to 2021.

The Group proposed not to pay dividends in 2021, set a target to pay dividends in 2022 at the rate of 15%/year.

Finding M&A associations, especially in the segment of renewable energy

The group continued to pursue the growth strategy of core businesses through M&A activities (through Gelex and its subsidiaries).

It conducted listing or registration for trading with shares at Gelex Infrastructure and increase capital, registered to list with Gelex Electric shares if necessary on the basis that the parent Group still held the controlling rate (Gelex Electric traded on Upcom on March 8, 2022).

In the segment of infrastructure, in 2022 Gelex would develop selectively and disburse investment in phases to develop projects in the list of investment-prepared projects such as: Vinh Hai Offshore Wind Power Cluster (800MW), Gia Lai Wind Power (100MW), DakLak Wind Power (200MW), Binh Phuoc 1, 2 Farm Solar Power (480MW), LNG Long Son and other projects.

In 2022, Gelex planed to look for M&A opportunities in renewable energy projects, and at the same time look for investment opportunities in clean energy projects such as hydroelectricity, biomass power, etc.

For the production and supply of clean water: the Group continued to invest in the remaining items of phase 2, increasing the capacity of Song Da Clean Water Plant to 600,000 m3/day and night, with the goal of completing, testing and putting into use in the fourth quarter of 2024.

With the industrial zone real estate segment: it continued to invest in synchronizing technical infrastructure/services in the industrial parks being implemented, prepared to invest in nearly 1,900 hectares of new industrial parks. The Group implemented the surveys and studies for a number of locations to develop about 4,300 hectares of industrial parks/complexes of industrial parks, services, new urban areas in localities with advantageous positions in infrastructure, investment attraction and business ability.

Source: Gelex: Đặt kế hoạch doanh thu 36.000 tỷ năm 2022, tăng trưởng 26%, niêm yết Gelex Hạ tầng và đầu tư 1.900 ha khu công nghiệp mới (cafef.vn)