GEE’s third quarter business results recorded a consolidated profit before tax of was VND 84.6 billion. By the end of September 2022, the consolidated profit before tax of this enterprise reached VND 663.2 billion, up by 14.6% compared to the accumulated same period last year.

Gelex Electrical Equipment Joint Stock Company (Gelex Electric, ticker symbol GEE – UPCoM) announced its financial report for the third quarter of 2022 with net revenue of VND 3,528.7 billion, profit before tax of VND 84.6 billion.

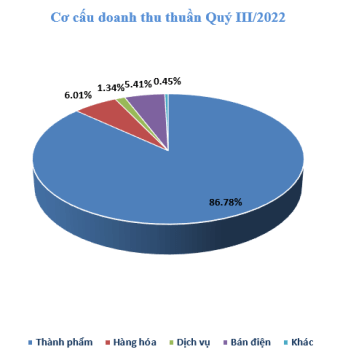

The structure of GEE’s net revenue in the third quarter came mainly from the production and trade of electrical equipment. This included: sales of finished products reached VND 3,062 billion, sales of goods reached VND 212.2 billion with main products such as CADIVI power cables, EMIC electrical measuring equipment, THIBIDI transformers, etc.

Along with that, GEE recorded revenue from the electricity production segment in the third quarter of VND 190.9 billion, and VND 546.9 billion accumulated in 9 months. Currently, GEE owns a large of power generation companies including hydropower, solar power, wind power and solar rooftop.

Due to the general decline in demand of the market and a number of other subjective reasons, such as: the member unit, CFT Vina Copper Co., Ltd., stopped production to relocate the factory in the first 6 months of the year, which had a significant impact on the third quarter revenue in particular and the accumulated revenue of 9 months of GEE.

According to newly released data of GEE and accumulation in the first 9 months, the Company recorded revenue of VND 12,790.5 billion, falling slightly by 3.7%. Gross profit in the first 9 months reached VND 1,608.5 billion, up by 28.64% over the same period in 2021. Profit before tax reached VND 663.2 billion, up by 14.6% over the same period in 2021.

In contrast, financial expenses in the third quarter were 271 billion. After 9 months, this figure was VND 801 billion, affecting GEE’s profit result. The main reason was due to interest expense coming from power generation company consolidation, exchange rate losses, hedging fees, etc.

In terms of cash flow, in the first 9 months, GELEX Electricity recorded a cash flow from business activities of VND 1,535.3 billion due to the plunge of inventory and short-term receivables; cash flow from investing activities was VND 351.6 billion, financial cash flow was negative VND 2,447 billion, mainly reducing debt and paying dividends to shareholders.

Along with that, confronting the increase in interest rates, GEE and its member companies actively lowered the proportion of outstanding loans. As of 9/30/2022, the ratio of liabilities/equity was 2.22 times, 2.86 times at the beginning of the year; while the debt/equity ratio is 1.62 times, 1.92 times at the beginning of the year.

According to GEE, CFT Vina Copper Co., Ltd. completed the relocation and successfully put new factory into operation. In the fourth quarter, the Company continued to implement the plan to invest in machinery and equipment to optimize production, streamline the apparatus, update advanced corporate governance applications, and invest in research on new high quality, environmentally friendly products. Besides, in the coming period, the Company would continue to look for M&A opportunities to complete the value chain of the electricity segment.

Established in 2016, GEE was formerly known as Gelex Emic Co., Ltd. by separating the segment of manufacturing electrical measuring equipment from Vietnam Electrical Equipment Joint Stock Corporation (now GELEX Group JSC). Currently, GEE is the parent corporation that directly controls 9 member companies, focusing on the main activity – industrial production (mainly electrical industry) including electrical equipment production and power generation.

GEE and its member units own reputable brands such as CADIVI power cables, EMIC electrical measuring equipment, THIBIDI transformers, HEM electric motors, etc., GELEX Ninh Thuan solar farms; Cluster of wind power plants GELEX Quang Tri 1, 2, 3; own and control the company operating the Song Bung 4A hydropower plant.