At the end of the third quarter, GELEX completed 68% of the profit before tax plan in 2022

GELEX Group Joint Stock Company (HoSE: GEX) announced its financial report for the third quarter of 2022.

Accordingly, in the third quarter, net revenue reached VND 7,014 billion, up by 16% over the same period, while profit before tax reached VND 282 billion, down by 30% over the same period.

This quarter’s net revenue structure was mainly contributed from the electrical equipment segment with VND 3,339 billion. GELEX’s other business segments all saw growth, contributing to the revenue structure as follows: building materials segment reached VND 2,611 billion, real estate and industrial parks reached VND 628 billion, energy & clean water reached VND 362 billion.

In the first 9 months of the year, GELEX’s total consolidated net revenue was VND 24,729 billion, up by 29% over the same period. GELEX’s consolidated profit before tax reached VND 1,767 billion, up by 25% compared to the same period in 2021, completed 68% of the full year plan in 2022.

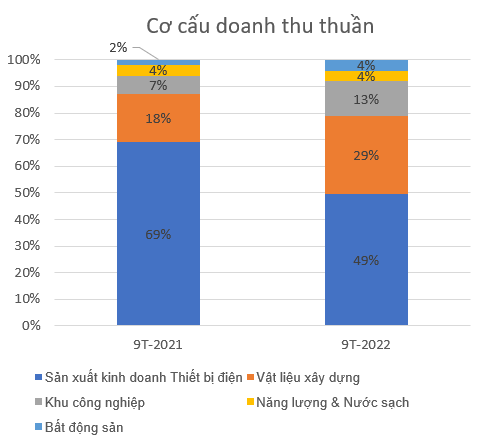

The main contribution to total net revenue was still the production and trade of electrical equipment segment, which reached VND 12,235 billion, accounting for 49%. The next was: building materials contributing VND 7,124 billion, accounting for 29% of the proportion; Real estate leasing, industrial park infrastructure and other ancillary services reached VND 3,097 billion, accounting for 13%; Energy and clean water reached VND 1,079 billion, accounting for 4%; Commercial real estate recorded VND 1,011 billion, accounting for 4%; other revenue reached VND 182 billion, accounting for 1%.

It can be seen that the proportion of GELEX’s revenue gradually balanced between the two core segments, which were electrical segment (electrical equipment and power generation) and infrastructure (industrial parks, real estate, building materials, clean water), etc.

At the end of the third quarter, in the operating segments, only the electrical equipment segment revenue decreased by 7% over the same period. This wasn’t out of expectation because CFT Vina Copper Co., Ltd., a subsidiary accounted for a relatively large proportion regarding revenue in the group of electrical equipment which had temporary suspended production to relocate its factory in the first 6 months of 2022.

In contrast, other business segments all saw revenue surge in the first 9 months of 2022. In terms of building materials group with products such as energy-saving glass, sanitary equipment, ceramic tiles, and adobe materials, etc., Viglacera revenue rose by 103% over the same period. Viglacera’s industrial park leasing and industrial park services also experienced an impressive growth, reaching VND 3,097 billion in revenue, up by 128% over the same period. In addition, revenue from commercial real estate and social housing, housing for workers around industrial parks of Viglacera also surged by 212% in revenue over the same period, reaching VND 1,011 billion after 9 months.

Through these figures, it can be seen that the consolidation of Viglacera was the right investment choice of GELEX, through which the Group both reduced dependence on electrical equipment and improved gross profit margin when increasing the proportion of sales in industrial parks leasing, real estate, and building materials. GELEX’s gross profit margin in the first 9 months of the year improved significantly to 21% compared to 15% in the same period in 2021, and gross profit reached VND 5,147 billion, up by 80% over the same period.

In addition to revenue and gross profit growth, due to market fluctuations, GELEX also recorded an increase in expenses such as selling expenses, administrative expenses, and financial expenses in the first 9 months of the year.

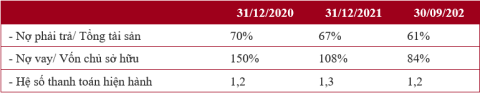

In addition, liabilities sank by 19% to VND 32,961 billion, of which loans and finance leases decreased by 20% to VND 17,624 billion. By proactively reducing payables and loans, GELEX would cut financial costs in the context of rising interest rates. Besides, GELEX’s financial situation was more and more positive and healthy, which was reflected in debt and solvency ratios.

In 2022, GELEX set a plan of VND 36,000 billion in revenue and VND 2,618 billion in consolidated profit before tax, a high growth rate of 26% and 27% respectively compared to the implementation in 2021. Hence, at the end of 9 months, GELEX completed 69% of the targeted revenue and 68% of the targeted profit before tax for the whole year.

Recently, GELEX entered the Top 50 Most Profitable Enterprises in Vietnam ranked by Vietnam Report. In the TOP 500 Most Profitable Enterprises in Vietnam 2022, GELEX ranked the 73rd, up 23 places compared to 2021. In the Group of Private Enterprises in the Top 50, GELEX ranked the 35th, up 16 places compared to 2021.