Gelex planned a profit of VND 1,380 billion in 2019, continued to expand into the segment of Industrial Park real estate

Gelex was in the process of strong restructuring

Vietnam Electrical Equipment Corporation (Gelex – Ticker Symbol: GEX) ended 2018 with many impressive numbers after a year of implementing a series of restructuring activities. From an enterprise operating in managing many subsidiaries, Gelex was advocating for restructuring, bringing all business activities into 4 main areas including Industry, Utilities, Logistics and Real Estate were represented by subsidiaries including Gelex Electrics, Gelex Energy, Gelex Logistics, and Gelex Land.

With the model of a corporation taking industrial production as the key, in 2018, Gelex continuously transformed and increased the ownership rate in subsidiaries to well implement the policy of business restructuring.

Gelex was aiming to manufacture and supply a full range of products in the electrical equipment portfolio for all 3 levels of Low, Medium and High voltage by increasing the ownership rate in enterprises in the segment to cover the product chain supplying for the power segment. The company was also continuing to consolidate the organizational model at the parent company according to a professional model, operating mainly in 4 main areas: Industry, utility infrastructure, logistics and real estate.

Revenue and profit in 2018 increased dramatically

As a result, revenue in 2018 achieved a growth of 14.3% over the same period, to nearly VND 13,700 billion – a record level of revenue ever. The profit before tax reached VND 1,533 billion, up by 41.6% compared to 2017, but only fulfilled 84.2% of the profit target set for the whole year. Profit after tax for shareholders of the parent company reached VND 942 billion, up by 47.8% compared to 2017.

Although it had not completed both revenue and profit plans, in 2018 Gelex had a remarkable growth in both revenue and profit compared to previous years. Gelex also gave an explanation for the failure to complete the annual plan, because Gelex had previously considered buying and controlling Dong Anh Electrical Equipment Corporation; however, in 2018 the State had not completed the divestment process out of this unit, the consolidation of revenue and profit on Gelex had not yet been carried out.

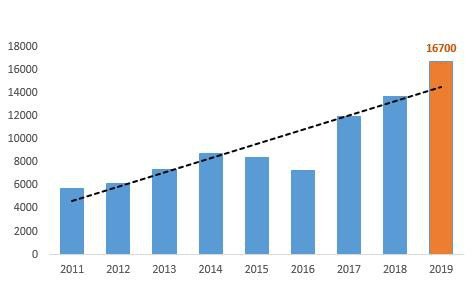

Gelex planned a profit of VND 1,380 billion in 2019, and continued to expand into the segment of Industrial Park real estate – Picture 2.

Gelex’s business results in recent years (VND billion)

In 2018, Gelex grew steadily in all business segments, in which, according to the report, the electrical equipment segment alone achieved a growth of 8.7% over the same period; the clean water segment grew by 13%, while the revenue of the logistics segment increased by 21% compared to 2017. As for the real estate segment, the company had completed and exploited the Gelex 52 Le Dai Hanh system, Melia Hanoi Hotel, Binh Minh Hotel No. 10 Tran Nguyen Han, Hanoi.

The scale of capital, and total assets increased sharply

The company’s accounting ratios changed rapidly. The total assets of the company increased by VND 3,500 billion compared to the beginning of the year, to VND 17,200 billion. Along with that, equity increased by more than VND 1,800 billion compared to the beginning of the year, to approximately VND 7,965 billion, of which owner’s contributed capital increased from VND 2,668 billion at the beginning of the year to VND 4,065 billion.

In terms of savings, by the end of 2018, Gelex still had VND 846 billion of undistributed profit after tax, VND 547 billion of share capital surplus. In addition, there was more than VND 77 billion of owner’s capital and VND 77 billion in development investment fund.

Lots of fiscal places for development in 2019

In 2019, revenue was expected to grow well when CAV’s new power cable factories, Canan 1 Hydropower Plant, Ninh Thuan Solar Power Project came into operation. In addition, the Corporation was also promoting investment in new power generation projects including Gelex 1,2,3 wind power project in Quang Tri, Huong Phung 2 wind power project, Huong Phung 3 wind power project and solar power project in Binh Phuoc, etc.

For the Real Estate segment, in addition to the optimal management and exploitation of existing real estates, Gelex also oriented to further develop the industrial park real estate segment with investment in social housing development, expanded the building materials segment production through increasing ownership in Viglacera Corporation.

Besides, the Board of Directors of the company also determined that it would continue to conduct mergers and acquisitions (M&A) of companies that could create great value in resonance with the current system.

Regarding specific targets, in 2019 Gelex expected total consolidated revenue to reach about VND 16,700 billion and consolidated profit before tax was estimated at VND 1,380 billion.