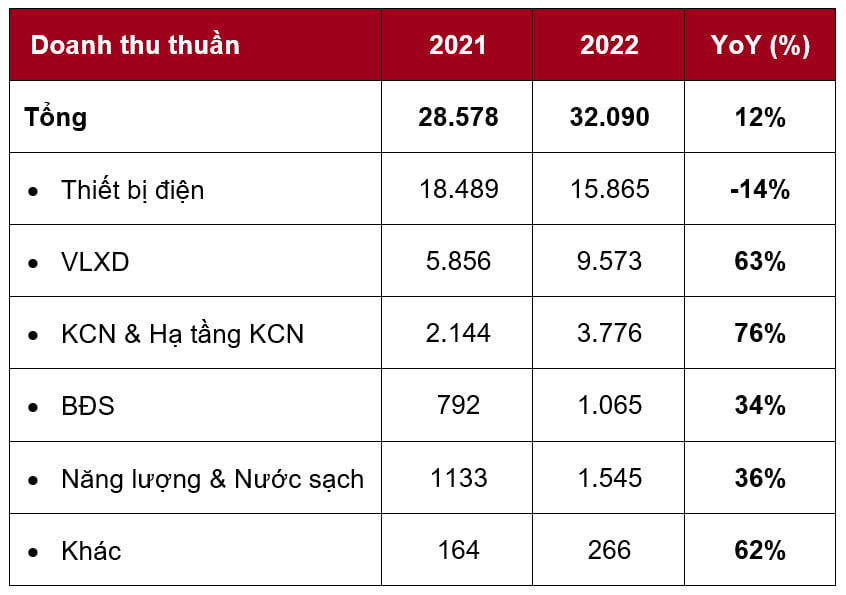

By the end of 2022, the Group’s consolidated net revenue reached VND 32,090 billion, up by 12% compared to the same period in 2021 and reached 89% of the set plan.

Based on data from the newly announced financial report of GELEX Group Joint Stock Company (HoSE: GEX), GELEX’s 2022 gross profit reached VND 6,458 billion, up by 48%. Gross profit margin also increased to 20% compared to 15% in the same period last year. Profit before tax of 2022 reached VND 2,093 billion, up by 2% compared to 2021 and reached 80% of the 2022 plan set out by the Group.

Like other businesses in the market, GELEX’s business results in 2022 were affected by fluctuations in the macro economy. Although maintaining good growth momentum, it is clear that some industry groups were affected by market demand such as building materials and electrical equipment. In addition, its wind power projects affected by climate change also resulted in a significantly lower output in 2022 than the expected amount.

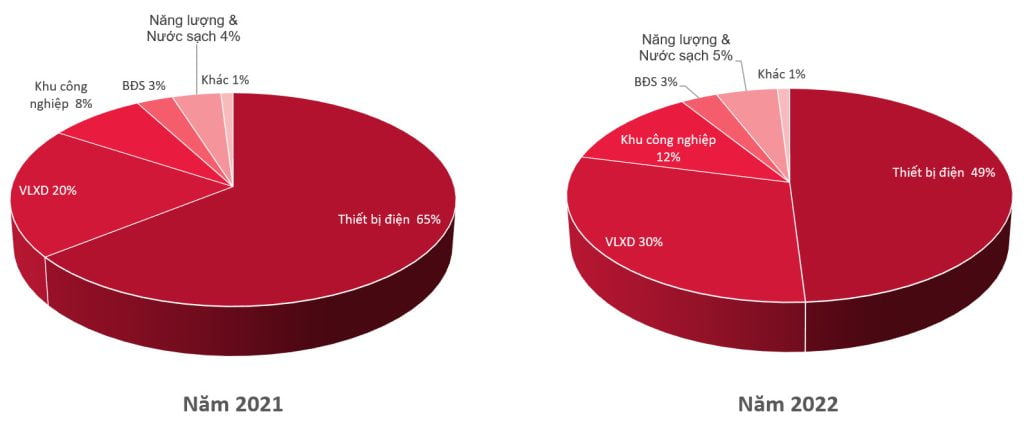

From the perspective of business segments in the GELEX system, according to newly released data, it can be seen that in 2022, all operating segments had a strong net revenue growth over the same period, except for electrical equipment due to a decrease in market demand and a part of the effect of the relocation of Thibidi, CFT factories in the first 6 months of 2022.

Thus, it can be seen that GELEX’s revenue in 2022, there was a more balanced contribution among the segments, reducing dependence on the electrical equipment segment compared to the same period in 2021 due to the consolidation of Viglacera from the second quarter of 2021 and other segments such as industrial park, real estate, building materials, and energy which had good growth in 2022.

In 2022, Viglacera Corporation (Ticker Symbol: VGC) recorded net revenue of VND 14,594 billion, up by 30% compared to 2021, reached 97% of the plan. Profit before tax reached VND 2,321 billion, up by 51% compared to the implementation in 2021 and 37% higher than the plan.

As of December 31st, 2022, GELEX’s total assets were VND 52,401 billion, down by 14% compared to 2021, mainly due to reducing short-term assets as GELEX actively reduced inventory, short-term receivables and short-term financial investments.

In order to actively deal with unusual developments in the financial market, GELEX actively reduced debt to reduce costs and financial pressure. The assets structure and capital of GELEX as of December 31st, 2022 was relatively balanced.

GELEX’s financial indicators such as debt ratio, payment ratio, operating efficiency ratio, etc. were all at the right levels and continued to be improved in the fourth quarter of 2022. A healthy financial situation helped GELEX face less risk in the volatile capital and interest markets.

In 2022, GELEX and its member units such as VIGLACERA, CADIVI, THIBIDI, etc.were honored as Vietnam National Brand. GELEX was in the TOP 50 largest enterprises in Vietnam and one of the 50 most effective business companies in Vietnam.

In 2023, GELEX claimed it would continue to focus on corporate governance, maximizing the efficiency of the value chain of its core business – industrial production and infrastructure. At the same time, it would be ready to accept potential M&A opportunities to bring growth in scale, increase competitive advantage, develop sustainably and serve long-term strategy in the future.